Support for Pre/Post Maternity and Childcare Leave

This post is also available in 日本語

As we explained in our previous article ‘What should a foreign resident woman do when she gets pregnant?’, the expenses pertaining to pregnancy and delivery are to be paid by yourself since they not covered by the health insurance. Further, the financial burden will increase with no salary if you take a leave of absence due to pregnancy and childcare. This time, we explain the outline of supports you will receive when you participate in the healthcare insurance and pension plan provided by your company towards absence from work during pregnancy and childcare.

Contents

Types of leave of absence

- Absence before and after delivery

So called ‘sankyu’: Leave of absence before and after delivery - Child-care leave

So called ‘ikukyu’: Leave of absence for childcaring

Not only women but men also can take this.

*There are the legal ‘childcare leave’ and the company’s ‘childcare leave of absence’.

In this column, we discuss about the legal childcare leave.

The financial support for maternity leave and childcare leave

There are four types of support working person can receive when taking maternity and child-care leave. You have to apply for each of them which may be prepared by your employee or the hospital. You would want to clarify beforehand for each type when and where to apply, whether you are eligible or not, when the payment is made, and the approximate amount to be paid including any other detail.

- [Exempted] Social insurance premium

- [Paid]Maternity allowance

- [Paid] Lump-sum allowance for childbirth and childcare/Lump-sum family allowance for childbirth and childcare

- [Paid] Childcare leave benefit

Social Insurance Premium Payment

The payment of social insurance premium by an individual and the company will be exempted when an employee takes maternity or childcare leave who subscribes to the health insurance for the period from the starting month of leave to the month prior to the ending.

When: At the beginning of taking a leave prior to the childbirth and the beginning of the childcare leave (application is required respectively)

Who: The company

Where: At a Pension Office

https://www.nenkin.go.jp/service/kounen/hokenryo-kankei/menjo/20140327-06.html

https://www.nenkin.go.jp/service/kounen/hokenryo-kankei/menjo/20140327-05.html

Maternity Allowance

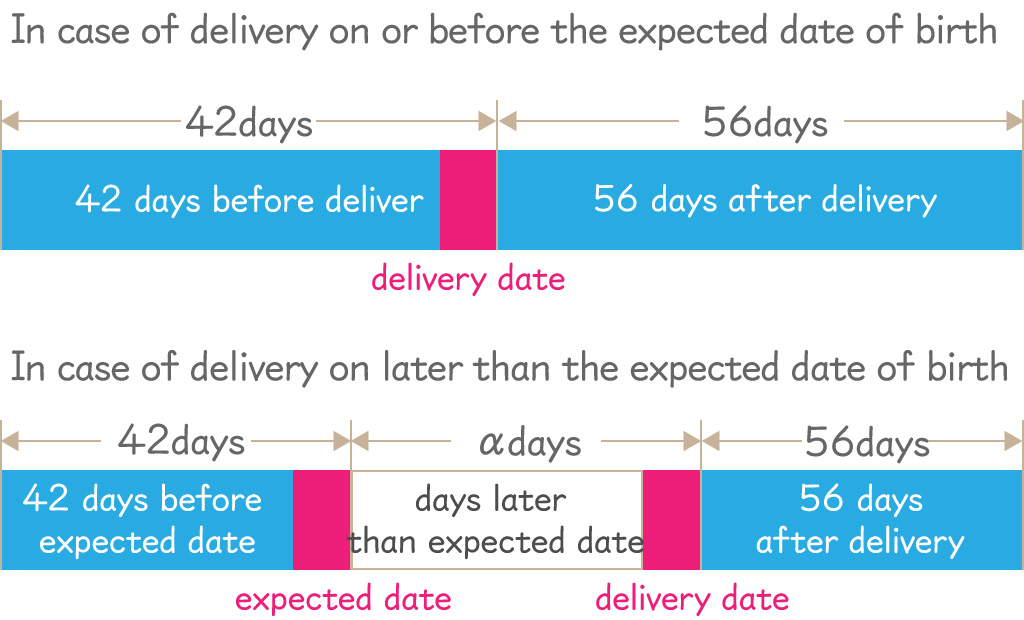

When the person belongs to the health insurance, the 2/3 of your salary shall be paid for the days of the maternity leave counting from 42 days before the delivery date (in case the delivery is later than the expected date, then, it’s before the expected date) to 56 days after the following day of the delivery. However, in case of a multiple pregnancy, the coverage starts on 98 days before the delivery date.

The salary means the average of the base monthly payment for the 12 months prior to the starting date of the maternity leave allowance. You have to be aware that the amount may differ depending upon various conditions such cases that the work duration is shorter than 12 months before the allowance payment starts or that you end up quitting.

When: After the maternity leave ends.

Who: Yourself and the company (the doctor’s or delivering nurse’s input needed)

Where: The health insurance association

http://www.kyoukaikenpo.or.jp/g3/cat315/sb3090/r148

The lump-sum allowance for childbirth and childcare/ The lump-sum family allowance for childbirth and childcare

When a person covered by the health insurance or his/her dependent family gives birth after more than four months (85 days) from the conception, 420,000 yen per one baby will be paid to cover the delivery expense. (It will be 404,000 yen when delivery is at a medical facility who has not joined the obstetric expense compensation system.) In case of multiple pregnancy, the support will be paid for each baby. Even in case of a miscarriage or a stillbirth, you can receive the lump-sum provided the pregnancy lasted longer than four months (85 days). When the direct payment system has been employed, you’ll have no worry because the payment will bedirectly paid to the hospital.

There are various circumstantial conditions and required documents and procedures are different respectively regarding this lump-sum allowance. You need to take extra cautions especially when you are planning to give birth in foreign country. Please examine beforehand.

Who: Yourself or the hospital

Where: The health insurance association

https://www.kyoukaikenpo.or.jp/g3/cat320/sbb31712/1948-273

Childcare Leave Benefit

If you belong to an employment insurance and meet certain guild lines, you will be paid 2/3 of your salary for the first six months for days you have taken the childcare leave until the baby reaches the first birthday. After six months the amount will be reduced to 50%. In some cases, the payment period may be extended. If some conditions are met, not only woman but also man may be eligible to receive.

The salary here in principle means the per diem amount at the beginning of taking childcare leave. However, the conditions are very confusing. The application needs to be done in every other months. The recipient may apply himself instead of the company. Although, as it is necessary to ask the company to fill out the document each time, it is advisable to discuss earlier.

When: Initially, two months after the beginning of the childcare leave (Every two months thereafter)

Who: The company (or the recipient)

Where: Hello Work (Public Employment Security Office)

https://www.hellowork.go.jp/insurance/insurance_continue.html#g2

Please check any special support offered by your living area or your company

Some of the municipality where you reside and/or your company often offers their own supporting system. It’s worth checking.

- [Explained by a Legal Professional] Points to consider when you wish to work in Japan

- What are “Wagara (traditional Japanese patterns)”? Meaning and Prayers Accompanying the Main Japanese Patterns

- How to Write/ “Taishokunegai (Resignation Requests)” and “Taishokutodoke (Resignation Notices)”

- [For Foreign Nationals] Examples of Questions Frequently Asked at Interviews

- Types of Sushi and Its History