How you can make your family in your home country subject to the tax deduction for dependent family

This post is also available in 日本語

While you work in Japan and send money to your family in your home country, your family is subject to the tax deduction for dependent family. This deduction is one of the tax deductibles which will lower your income tax. When you are supporting your family, the deduction applies to each of the dependents. However, to make the dependents living in the foreign country subject to this deduction, the documentation is required. Here, we talk about the deduction for dependents.

Contents

The object person of this tax deductible

The decision of dependent family deduction takes the income and ages of dependents into account. Whether the object family live in Japan or not, following conditions need to be fulfilled to apply to the deduction.

- Over 16 years of age

- Kinfolk except the spouse (within sixth degree of kinship of blood relatives and within third degree of relatives by affinity)

- Sharing the same household with the support obligor

- Annual income of below 380,000yen

(when income source is solely the salary, below 1,030,000yen) - Not receiving any salary for the year as a fulltime worker who files the Blue Tax Return or not a fulltime worker who files the White Tax Return

How much is the deduction for dependents?

The amount varies depending upon the age of the dependent. The minimum amount of the deduction is 380,000 yen and the maximum is 630,000yen.

A quick view of dependents deduction

| Classification | Deductible Amount | |

|---|---|---|

| Regulardependent relatives (Over 16 years old as of 12/31 of the year) | 380,000yen | |

| Specified dependent relatives (Over 19 but under 23 years old as of 12/31 of the year) | 630,000yen | |

| Elder dependent relatives (Over 70 years old as of 12/31 of the year) | Not living together | 480,000yen |

| Living together (The lineal ascendant of the taxpayer or its spouse who regularly lives together) | 580,000yen | |

Required Documents

When you want to make your dependent family living in a foreign country subject to the dependent deduction, two kinds of documents are required. If the documents are in foreign language, the Japanese translation is required as well.

- Document(s) showing the relationships among relatives

- Document(s) related to money remittance

Document(s) showing the relationships among relatives

This is to confirm the relationships among family members and one of the followings is required.

- A copy of the supplementary family register and other documents issued by the government or local authorities and a copy of the passport of your family living outside of Japan.

- Documents issued by the foreign government or the foreign local authority.

(The documents need to show the name, birthdate and address or residing place of relatives living in that country.)

If no document is available showing the name, birthdate and the address, it can be substituted by combining plural documents.

Examples of the combination

| Children | The birth certificate |

| Your parents | Your birth certificate |

| Your grand parents | Your birth certificate Your father’s/mother’s birth certificate |

| Your siblings | Your birth certificate Your siblings’ birth certificate |

| Your spouse | Your marriage certificate |

| Your spouse’s parents | Your marriage certificate Your spouse’s birth certificate |

| Your spouse’s grand parents | Your marriage certificate Your spouse’s birth certificate Your parent(s)’s birth certificate |

| Your spouse’s siblings | Your birth certificate Your spouse’s birth certificate Siblings’ birth certificate |

Document(s) related to money remittance

One of the following documents is required to clarify that the money remittance is made to support the family or for educational expenses in a foreign country.

- A document issued by a financial institution or a copy thereof certifying that the money was remitted from a resident to the relative residing in overseas by the foreign exchange transaction through the financial institution.

- A document issued by a credit card company or a copy thereof which clearly shows that you make up the equivalent amount of money to your supporting family when a purchase of daily necessities is paid by the credit card issued by the credit card company.

In case you want to apply the dependent tax deduction to multiple family, you need to remit individually. In addition, if you send money to the same relative in overseas more than three times in a same year, you can omit the submission or presentation of documents related to other money transfers by submitting or presenting a certain detail and documents relating to the first and last remittances in the year to the relative in overseas.

However, the resident person himself needs to keep the documents not submitted or presented.

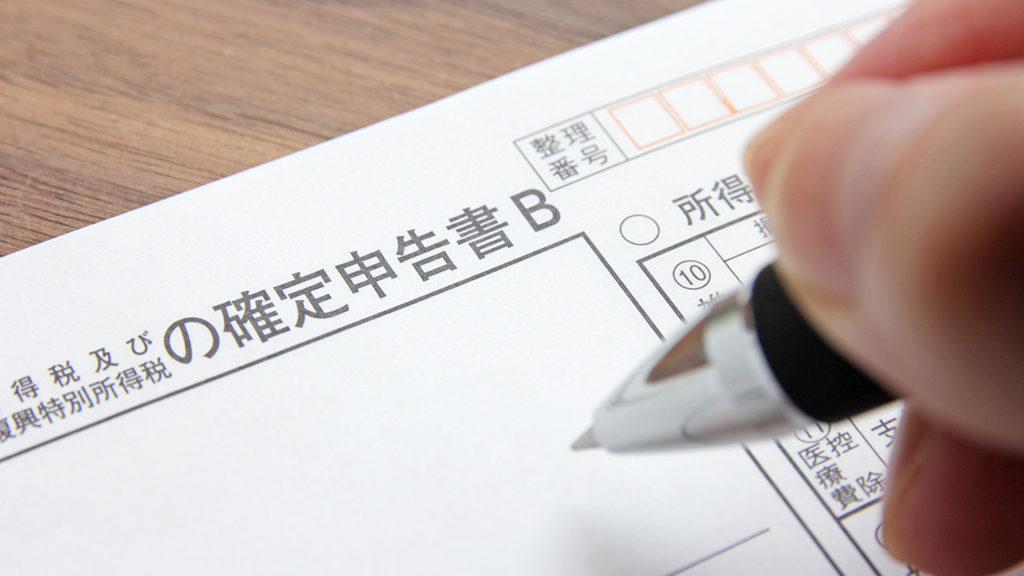

Filing the income tax return

When you claim for the tax deduction for dependent family, you need to file an income tax return with a tax office. The filing period is between February 16th and March 15th of the following year of the subject tax year. If you miss this period, you still can file within the maximum of five years thereafter.

If the year-end tax adjustment is done by your company, you need to submit the dependent certificate to the company. The amount of the dependent deduction increases more in line with the number of dependents. You must save the receipts of remittances and credit card use until you file the tax return.

Confirm with the HP of the National Tax Administration Agency

This column showed you only the key points. Foe more details, please consult with “The application of the deduction for dependent in regard to relatives residing overseas (in Japanese only)” at the home page of the Tax Agency.

https://www.nta.go.jp/publication/pamph/pdf/kokugaifuyou_leaflet.pdf

- Advantages and Disadvantages of Making a Second Rakuten Card

- What are “Wagara (traditional Japanese patterns)”? Meaning and Prayers Accompanying the Main Japanese Patterns

- Types of Tea Often Drunk in Japan and Their Characteristics

- What is a yukata? Explanation of their features, how to wear them, and how they differ from a kimono

- Types of Sushi and Its History