Easily Explained. What is “Furusato Nozei”?

This post is also available in 日本語

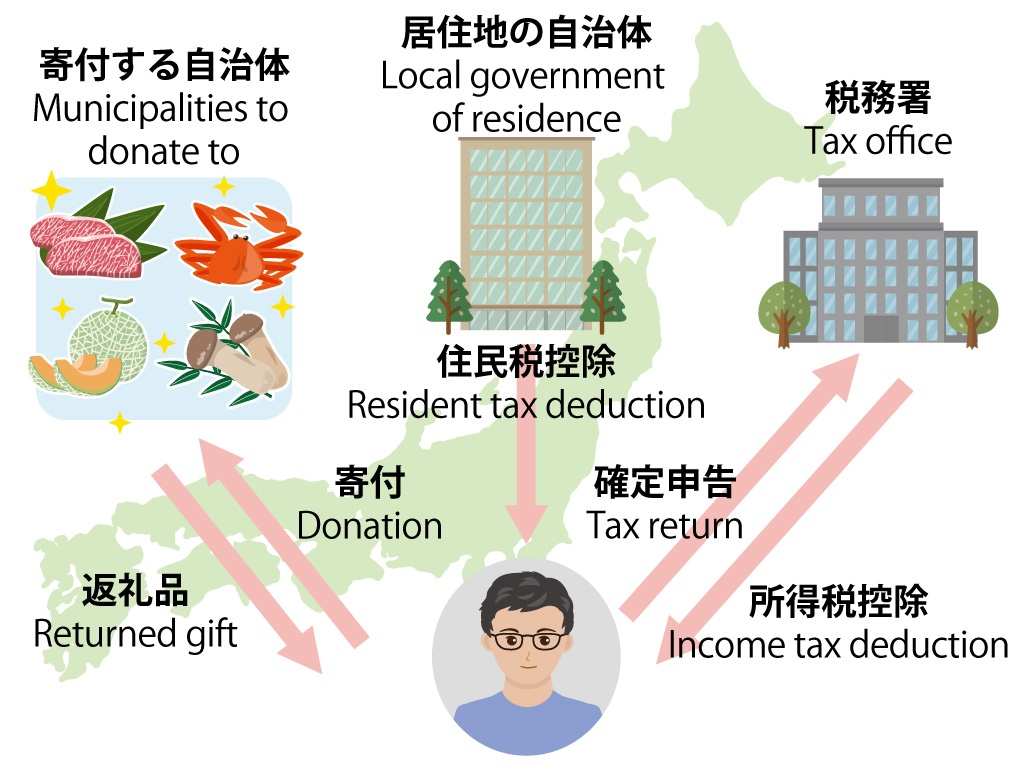

In Japan, there is a system called “Furusato Nozei” (hometown taxation), in which you can make donations to local governments (prefectures, cities, towns, and villages). With this system, if you declare in your tax declaration that you have contributed, part of the contributed amount will be deducted from your income tax and residence tax. Among these, some municipalities allow you to choose how your donation will be used and receive a gift in return. A variety of goods and services such as special local goods, accommodation vouchers, and experiences can be obtained as return gifts, and this, in itself, can be a good opportunity for foreign residents in Japan to learn about the characteristics of a wide variety of regions. Today, I would like to explain “Furusato Nozei”.

Contents

What is Furusato Nozei?

In Japanese, the place where you were born or grew up, or a place you are familiar with is called “Furusato”. For this reason, when you say “Furusato Nozei”, it may be misunderstood as being a system of paying tax to the local government of your hometown. However, it actually refers to “donating to local governments throughout Japan, not just your hometown”.

If you work in Japan, normally, you pay tax to the local government where you live. For this reason, local governments in urban areas have high tax revenues, while they are much lower in the more rural areas. This is a mechanism through which, by donating to the “region you wish to support”, such as the area where you were born, or an area that has been good to you, you can develop the environment.

[Examples of how to use Furuzato Nozei]

https://www.soumu.go.jp/main_sosiki/jichi_zeisei/czaisei/czaisei_seido/furusato/topics/20180330_case_study.html

Merit

Goods in return

The main reason why Furusato Nozei has become so popular is that some municipalities will send you a gift in return. The main reason why Furusato Nozei has become so popular is that some municipalities will send you a gift in return. There are also portal sites that allow you to filter based on your “Furusato Nozei” payment based on the items to be returned, just as a mail order site.

- Meat, seafood, eggs

- Rice, bread

- Vegetables, fruit

Confectionery, noodles, processed foods, condiments, oil - Beverages, alcohol

- Handicrafts

- Electrical products

- Travel, tickets, experiences

- Certificates of appreciation, commemorative items, etc.

Tax returns/deductions

Any amount in your donation that exceeds 2,000 yen will be refunded from your income tax for that year and deducted from your residence tax the following year. (There is a limit to these deductions, and this limit will depend on various conditions.)

Choosing the region and how to use it

It is possible to choose which region you contribute to, and how it will be used.

- Reconstruction support for regions that have been affected by earthquakes and typhoons

- Improved education and welfare

- Town building and environment conservation etc.

Disadvantages

It will not help you save or reduce tax

Just because you use the “Furusato Nozei” scheme, that does not help you save on tax or reduce your tax bill. It is nothing more than a system to deduct the contribution amount from income tax and residence tax.

However, depending on the local government, it is possible to receive 30% of the contributed amount in returned goods. Additionally, if you use the Furusato Nozei portal site, you may be awarded points. You can think of it as “a good deal getting returned goods and point”.

Complexity of calculating the upper limit

Depending on the contribution amount, there may be a limit in the amount to be deducted. Any amount exceeding this limit cannot be deducted. The upper limit differs depending on income and family composition. As this depends on other deductions such as the housing loan deductions and medical expense deductions, it is a highly complex calculation. The only way to get an accurate calculation is to check this with your local government in January or February of the year after your donation.

You can use the information provided by the Ministry of Internal Affairs and Communications or the simulation function on the Furusato Nozei portal site to check the upper limit.

[Explanation of the MIC]

https://www.soumu.go.jp/main_sosiki/jichi_zeisei/czaisei/czaisei_seido/furusato/mechanism/deduction.html

[Simulation on the Furusato Nozei portal site “Satofuru”]

https://www.satofull.jp/static/calculation01.php

Procedures are troublesome

In principle, you will need to file a tax return to apply for the deduction. However, if you meet the conditions of donating to less than five municipalities or prefectures in one year and you are a salaried employee who does not need to file a tax return or a resident tax return, you can use the “one-stop special system”. This is easy to apply for.

- One-stop Special System

The application process is simple; however, you must make sure you submit the application form for the one-stop special system and your identification documents, without discrepancy, by January 10 of the year following your donation. You can get your application form for the One-Stop Special System at the Furusato Nozei payment portals. This only provides a deduction for residence tax. - Final Income Tax Return

This is a tedious application process, but it enables you to deduct income tax and residence tax. You will need to file your tax return documents by around February 16 to March 15 of the year following your donation and submit a “Certificate of Deduction for Donations” or “Certificate for Receipt of Donations”. This “Certificate of Deduction for Contributions” can only be issued by specified businesses designated by the National Tax Agency Commissioner.

https://www.nta.go.jp/taxes/shiraberu/shinkoku/kakutei/koujyo/kifukin/tokutei.htm

Procedures for using Furusato Nozei

- Estimate the upper limit for your tax deduction

- Decide which municipality you would like to donate to (and in case of return gifts, decide which you would like to receive) and apply.

- (In case of return gifts) Receive the return gift

- Receive the “Certificate of Deduction for Donations” or “Certificate for Receipt of Donations”

- Deduction proceedings

Recommended Furusato Nozei portal sites

When using Furusato Nozei, it is convenient to pay your taxes using a Furusato Nozei portal site. As each has different characteristics, you can choose the one you find easiest to use.

- Rakuten Furusato Nozei

This is for people who often use Rakuten Market and people who look to win points. If you use your Rakuten card, you can get up to 30% of your points back.

https://event.rakuten.co.jp/furusato/ - Furunabi

This is recommended for people who frequently use Amazon and who want to search for electrical products as return gifts. Up to 12% of your points will be returned and can be exchanged for Amazon gift certificates.

https://furunavi.jp/ - Furusato Choice (Point refund : None)

This is recommended for people who want to choose from a large range of options. This is a long-established site and in terms of the number of municipalities it covers and the number of returned goods, it is one of the largest.

https://www.furusato-tax.jp/ - Satofuru (Point refund : None)

This is a good option for those who want to receive their returns as quickly as possible. The options for return gifts are wide-ranging and even include unique large-volume return gifts.

https://www.satofull.jp/

Summary

Furusato Nozei donations made between January 1 and December 31 of each year are reported the following year. In basic terms, donations by 23:59 on December 31 are considered donations for that year. Donations received after 0:00 on January 1, on the other hand, will be considered as donations for the following year. Note that the timing of payment confirmation will differ depending on the method of payment. You should also ensure you file your tax return before the deadline if you have donated that year.

- Advantages and Disadvantages of Making a Second Rakuten Card

- What are “Wagara (traditional Japanese patterns)”? Meaning and Prayers Accompanying the Main Japanese Patterns

- Types of Tea Often Drunk in Japan and Their Characteristics

- What is a yukata? Explanation of their features, how to wear them, and how they differ from a kimono

- Types of Sushi and Its History