Consumption Tax Rate is to be raised to10%–How to identify things applicable to Reduced Tax Rate system

This post is also available in 日本語

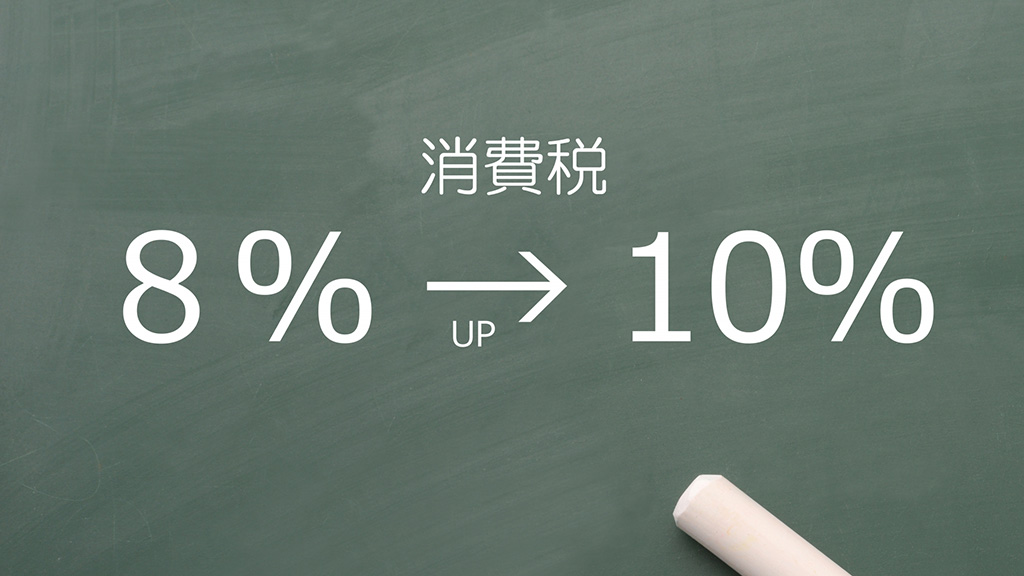

The consumption tax rate will be raised to 10% from 8% effective Oct. 1, 2019. Simultaneously, “Reduced tax rate system” and “Point return system” will be introduced. Please do not confuse these because they have different terms, purpose and contents.

- Reduced tax rate system

Term: A transitional measure (the ending date undecided)

Purpose: In economical consideration for low income people

The 8% reduced tax rate is applied only to certain subject items. - Point return system (cashless / consumer return business)

Term: For nine months from the tax increase (to June 30,2020)

Purpose: To promote cashless payment

You will receive points when using a certain cashless payment method to purchase goods at certain stores and EC sites.

We explain here about the Reduced Tax Rate System.

Contents

What is the reduced tax rate system?

This is a system which lowers the consumption tax rate on daily necessities temporarily to lighten the tax burden. The subject items include foods and drinks except eating-out and alcoholic beverages, and subscribed newspaper issued more than twice a week.

Which foods and drinks are eligible for the reduced tax?

- Foods and drinks for human consumption

- Meat, sea food, vegetable, snacks, water, juice, etc.

- Take-out, delivery (to home or elsewhere)

- Meals provided at schools and pay elderly care homes

- Items priced below 10,000 before tax and being over 2/3 of price for foods (such as snacks come with free gift)

A guideline is “foods you cook at home or drinks you consume at home.”

Non-eligible items include

- Pet foods

- Eat-out, food court, eat-in and catering

- Liquor

- Drugs and quasi-drugs

For example, when you eat hamburger in the shop, it’s non-eligible. You have to indicate whether you eat in the shop or take out when you place orders. Therefore, in the case you eat in the shop and carry out the left-over, the tax rate doesn’t change.

Conditions to make newspaper eligible for the reduced tax rate

- Published more than two times a week

- A term subscription

- Carrying articles concerning general public interest

When these conditions are met, English papers and sport newspapers will be eligible, too.

Followings are not eligible!

- Buying newspaper at convenient stores or at a station kiosk

- Reading newspaper on a web site

- Books and magazines

Eligible? or Not eligible?

| 8% | 10% | |

| Convenient store | Take-out | Eat-in |

| Amusement park | Eating while walking | Eating at eating facility |

| Movie house | Eating at the seat | |

| Drinks | Energy drinks (refreshing drinks) | Nutritious drinks (quasi-drug) |

| Liquor | Non-alcoholic beer (legally, not a liquor) | Legally,a liquor |

If You are not certain, check!

Check before you purchase

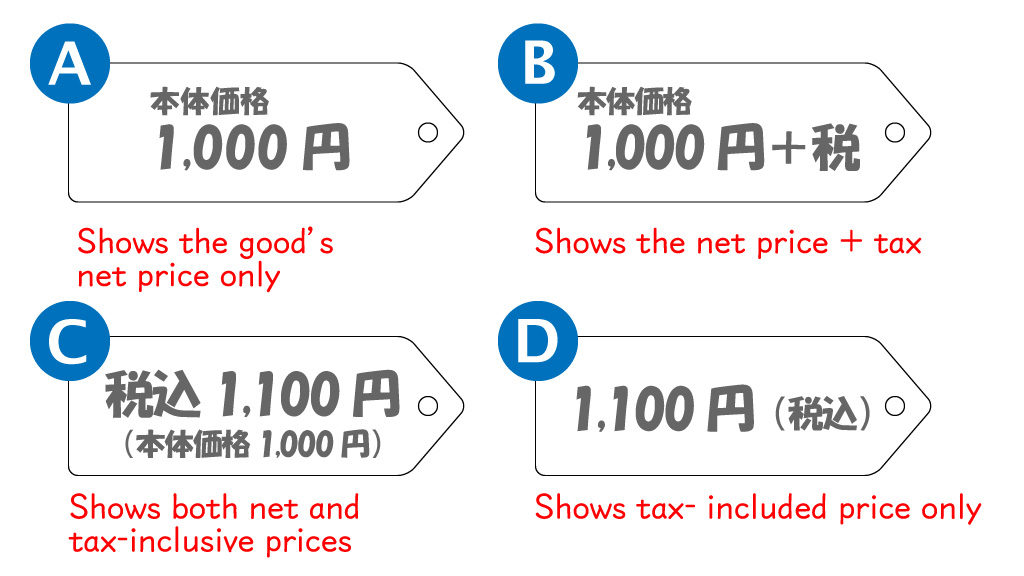

Although the price tags are scheduled to show collectively the following C or D below by 3/31/2021, there may be four different ways to show prices at this moment.

Further, the tax rate differs on the same good when the place, such as fast food shops and Soba shops, offers both eat-in and take-out services. Before you purchase, please closely look at price tags and prices shown on the menu, and if you are not sure of the consumption tax rate on your purchase, check with the store.

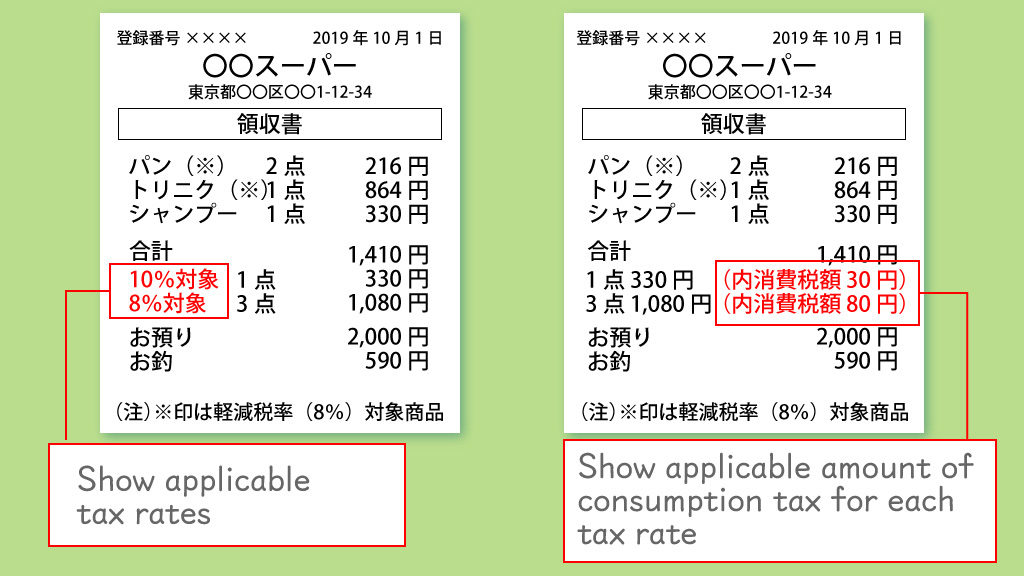

Check the receipt afterwards

When you check your receipt, you can verify which good was subject to the reduced tax rate and the total price you paid for at each tax rate

- Advantages and Disadvantages of Making a Second Rakuten Card

- What are “Wagara (traditional Japanese patterns)”? Meaning and Prayers Accompanying the Main Japanese Patterns

- Types of Tea Often Drunk in Japan and Their Characteristics

- What is a yukata? Explanation of their features, how to wear them, and how they differ from a kimono

- Types of Sushi and Its History