[2022 Version] Rakuten Card Application Process

This post is also available in 日本語

Credit cards issued overseas cannot be used for settlement in Japan. Rakuten Card is a card issued in Japan. If you are over the age of 18 and resident in Japan, you can apply for a card even if you are a foreign national or foreign student. It is said that the screening is relatively easy to pass too. It is easy to collect points that can be used with the Rakuten Group, and the card is very popular with people living in Japan.

On this occasion, therefore, I shall introduce how to apply for and make a Rakuten card. Please read this in conjunction with previous articles on this topic.

Articles related to the Rakuten Card

- What is the “Rakuten Card” a popular credit card in Japan?

- Characteristics of the Rakuten Premium Card and Comparison with the Rakuten Card

- Which Rakuten Card is Better? Introduction and Recommendations

- Procedure for applying for and making a Rakuten Card

Contents

Flow from applying for the Rakuten Card to receiving rewards on joining

- Prepare information required in advance

- Applying from a PC or smartphone

Once you pass the entry screening, your card shall be issued and sent to you - Receive the card

- Receive entry rewards(new member rewards and rewards on usage).

Preparation for applying for the Rakuten card

Personal identification documents(Residence card, Special Permanent Resident Certificate)

Confirm the below.

- Expiry date has not been exceeded

- Current address is registered

- Name described on the ID confirmation documents

Unless you apply as described on this document, you may fail the screening

Japanese bank account information

A Japanese bank account opened by the applicant is required to register for an account from which the withdrawal can take place. Prepare your “cash card or bankbook” to confirm the account number and branch number.

Contact

Requires an email address that can be immediately verified and a phone number where person in question can be contacted.

Applying for the Rakuten card

Use your computer or smartphone to apply at the URL below. If you want to increase your credit limit, and are a working adult, we recommend applying for the Rakuten Premium Card. If you are a student, we recommend applying for the Rakuten Card Academy.

Rakuten Card

| Annual fees | Free of charge |

| Point return rate | 1.0% to 3.0% |

| International brand |  |

| E-money |  |

| Limit amount | Up to 1 million yen |

| ETC annual fees | 550 yen (tax included) |

| Additional cards | ETC card Family card |

| Travel insurance | Overseas travel accident insurance |

| Point name | Rakuten points |

Points to note

- No. 1 in Customer Satisfaction for 13 consecutive years*2021 Japanese Customer Satisfaction Index Survey Credit Card Industry

- Shopping at Rakuten market gives three times the points reward!!

* Privileges are subject to limits and conditions. - Card with e-money “Edy” loaded

- Includes “Anshin” function to respond to problems

Rakuten Premium Card

| Annual fees | 11,000 yen (tax included) |

| Point return rate | 1.0% to 5.0% |

| International brand |  |

| E-money |  |

| Limit amount | Up to 3 million yen |

| ETC annual fees | Free of charge |

| Additional cards | ETC card Family card |

| Travel insurance | Domestic travel accident insurance Overseas travel accident insurance |

| Point name | Rakuten points |

Points to note

- Free Priority Pass with access to airport lounges throughout the world!

- Shopping at Rakuten market gives five times the points reward!!

- Automatically added overseas and domestic travel insurance!

- No Rakuten ETC card annual fees!

- Six times point return when shopping at Rakuten Market in your birthday month!

Rakuten Card Academy

| Annual fees | Free of charge |

| Point return rate | 1.0% to 3.0% |

| International brand |  |

| E-money |  |

| Limit amount | Up to 300,000 yen |

| ETC annual fees | 550 yen (tax included) |

| Additional cards | ETC card |

| Travel insurance | Overseas travel accident insurance |

| Point name | Rakuten points |

Points to note

- Able to use “Rakuten Gakuwari” (automatically applied for students until the age of 25)

- High level of point return when used for Rakuten Books or Rakuten Travel

- Usage limit of “Up to 300,000 yen” prevents overuse

- After graduation, you automatically switch to the “Rakuten card”

Below, we shall describe how you should apply if you are not a Rakuten member, using the “Rakuten Card” screen. (By becoming a Rakuten Member before applying, it becomes possible to save the information you entered during this process.)

Enter basic information

Select the brand and card design you wish to use.

The design you can select changes according to the brand you choose.

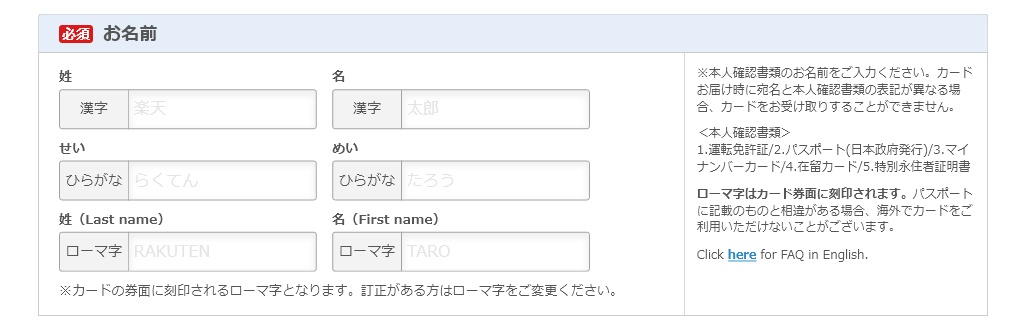

Enter your name.

Enter the same information in Kanji as is found on your identification document. You may omit any middle names you have only if the name is too long to type.

For hiragana, enter furigana in hiragana.

Romaji is the notation that will be printed on the face of the card. If this matches the information on your passport, you can relax knowing that the card will be usable overseas.

Enter your gender/date of birth/telephone number 1/email address.

The “mobile phone/smartphone” field in the e-mail address is the e-mail address issued by your mobile carrier. If you use a Google (@gmail.com) or Apple (@icloud.com) address, enter it in the email address field for the computer, even if you normally use that address on your cell phone or smartphone.

Answer the following items:

- Select whether or not you would like to receive notification messages from Rakuten Card and Rakuten Points Card。

- Address

Make sure that you enter your current address in Japanese characters. If the characters do not fit, you should omit the apartment name rather than the room number. - Family information

Select your family structure - Number of people in the household

Select the number of persons living in the same household, whether living separately or together. (The person concerned is counted as one person.) - Residential situation

Reply regarding your status in the house you currently live in, that is whether you own, rent, or live in a dormitory. - Years of residence

- Payment of housing loan or rent

Select whether or not this applies not only to you or to the other people living in the same household as you as well.

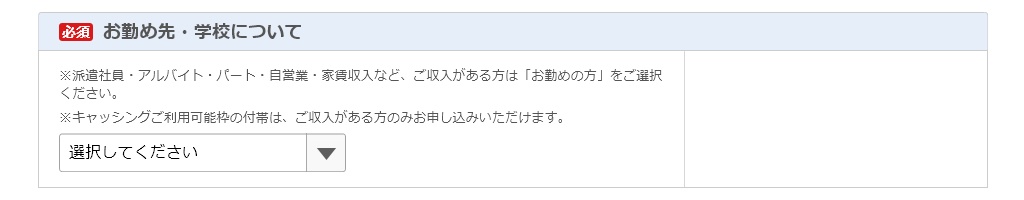

Enter your place of work or school.

If you have any income from any type of employment, such as full-time, temporary, or part-time, select “Employed” and enter your annual income including tax. Select “Student” in case of an international student. (Several questions may be added for this item, depending on the selections you make.)

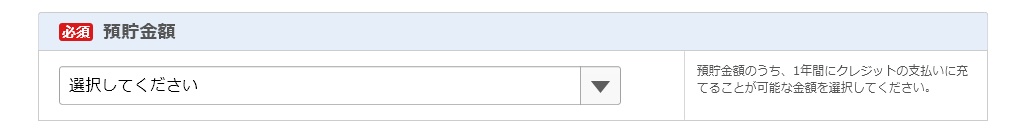

Enter the balance of your savings account.

Honestly enter the amount of savings in the Japanese bank account that you have opened.。

Answer in regard to the following items.

- Billing address

- Purpose of use for the card after membership

When used for regular shopping, you should choose “Use for regular shopping, etc.” - Amount loaned from other companies

Enter the amount honestly. - Equipped with Edy function

Prepaid electronic money functions are available free of charge, so you should apply for any you are interested in. You can also set the auto-charge feature. - Notifications from Rakuten Edy

Enter the account from which to pay the amount used.

You can only register accounts with the name you use to apply for your card.

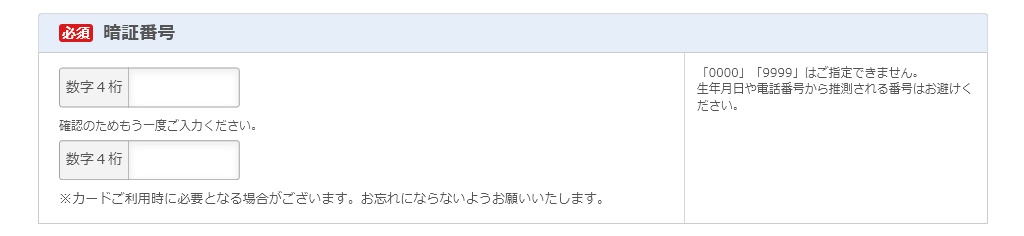

Set your pin code.

Enter a 4-digit number you will not easily forget. You cannot enter “0000” or “9999”. Avoid using numbers that are easy to guess, such as date of birth or telephone number.

This completes the entry of basic information. Click the <Next> button and proceed to “Enter workplace information”.

Entering workplace information

If you select “Worker” in basic information

- Workplace name

- Name of prefecture where workplace located

- Workplace telephone number

Do not enter your number, but rather enter a fixed telephone number for the workplace. - Number of years worked

- Job type

- Occupation

- Industry type

- Confirmation of driver’s license, etc.

If you select “Student” in basic information

- School or college name

- Confirmation of driver’s license, etc.

Once you have entered the workplace information, click the “Next” button, and move to “Enter Rakuten member registration information”.

Enter Rakuten member registration information

The email address you entered in basic information shall become your Rakuten member user ID.

Set your Rakuten member password!

Enter your desired string that is “6 characters or more” in “half-sized alphanumeric characters”.

Once you have set whether to receive Rakuten member news or not, you will need to confirm whether the displayed “Rakuten member registration information” is correct or not. The automatically displayed information is the information entered as basic information. If there are any mistakes, click the <Return to Basic Information Input>button, and correct your basic information.

If there is no problem, click the <Next> button and move to “Enter Rakuten Member Registration Information”.

Enter your payment account information.

Enter the account information for the financial institution selected in basic information.

- Name of financial institution

- Branch number

- Account number

Once you have finished inputting, click the <Confirm entered content> button.

When the “Confirm Account Information” screen appears, check the information and, if everything is correct, click the “Apply to Financial Institution” button. You will be taken to the automatic account transfer application page on the financial institution’s website. (Please note that if you close the Rakuten Card site during the financial institution site procedure, or if the procedure takes too long, you will have to start over from the beginning.)

Family Card

Once you complete the card application, you can also choose a family card. If you want to use this, enter the names of family members in the application instead of your own.

Membership screening and card issue

Once all the information has been entered, you will receive a “Notification of Application Receipt” e-mail.

You can check the status of your membership screening and card issuance at the following URL Enter the “Card Application Receipt ID, your date of birth, and the last 4 digits of your phone number” in the body of the e-mail, and click the <Check Issuance Status> button.

https://apply.card.rakuten.co.jp/status/input.xhtml

Receive your Rakuten card

If the membership screening is successful, the card will be issued and delivered in approximately one week.

The credit card will be delivered by mail requiring personal identification (specified matter transmission type) by Japan Post or by Sagawa Express with receiver confirmation support. Only the person who applied for the card can receive the card. When your card is delivered, be sure to check the “email just before delivery” that comes before it arrives.

When receiving, you must also present a photo identification document, so please have your Residence Card or Special Permanent Resident Certificate handy.

Receiving entry rewards (new entry rewards and card usage rewards)

When you receive your Rakuten Card, receive your reward points. You can use each point as 1 yen.

Entry rewards

You will receive these points when you apply for and join in Rakuten Card for the first time. These are normal points so there is no expiry date. Please note that to receive this service, you must register with Rakuten e-NAVI, the online service for Rakuten Card members only.

3,000 reward points for card usage

If you apply for Rakuten Card for the first time and meet the following two conditions after entry, you will automatically receive these points around the end of the following month. These are time-limited points so they have an expiration date. Be sure to use them before they expire!

- Using the card for the first time

Use the card by the end of the month following the “date of application” for the card (not eligible for cash advances) - Account Transfer Settings

Complete the account transfer setup by the 25th of the second month following the “date of application” for the card.

Additionally, check the information on the website carefully, as brand campaigns may also be running.

Rakuten Card entry screening

To make the screening process as easy as possible, we have outlined the key points you need to know.

- Apply with the name described on your personal identification

- For “Purpose of use after entry,” select only “Use for everyday purchases, etc.

- Set cashing to 0 yen

- Do not apply for automatic revolving payment service

- If you fail the screening once, you can apply again after six months have passed

Longer stays, more stable income, and longer periods of service are useful when applying.

If you have problems

If you face problems when applying, such as difficulties with the Japanese language screen, the process does not work properly, or you are unable to receive your card because you are not home, contact the contact center. An English-speaking representative will call you back.

【Contact Center】

Tel. 0570-66-6910 / 092-474-6287 (9:30-17:30)

Press “0#” when you hear the voice guidance.

【FAQ in English】

https://support.rakuten-card.jp/category/show/531?site_domain=guest

Summary

Applying for a credit card can be hard work. If you are not fluent in Japanese, you may feel uneasy about the process. Rakuten Card, though, tends to be more accessible than other cards. There is also a contact center that provides assistance in English. If you need a card issued in Japan, you should definitely try applying.

Rakuten Card

| Annual fees | Free of charge |

| Point return rate | 1.0% to 3.0% |

| International brand |  |

| E-money |  |

| Limit amount | Up to 1 million yen |

| ETC annual fees | 550 yen (tax included) |

| Additional cards | ETC card Family card |

| Travel insurance | Overseas travel accident insurance |

| Point name | Rakuten points |

Points to note

- No. 1 in Customer Satisfaction for 13 consecutive years*2021 Japanese Customer Satisfaction Index Survey Credit Card Industry

- Shopping at Rakuten market gives three times the points reward!!

* Privileges are subject to limits and conditions. - Card with e-money “Edy” loaded

- Includes “Anshin” function to respond to problems

Rakuten Premium Card

| Annual fees | 11,000 yen (tax included) |

| Point return rate | 1.0% to 5.0% |

| International brand |  |

| E-money |  |

| Limit amount | Up to 3 million yen |

| ETC annual fees | Free of charge |

| Additional cards | ETC card Family card |

| Travel insurance | Domestic travel accident insurance Overseas travel accident insurance |

| Point name | Rakuten points |

Points to note

- Free Priority Pass with access to airport lounges throughout the world!

- Shopping at Rakuten market gives five times the points reward!!

- Automatically added overseas and domestic travel insurance!

- No Rakuten ETC card annual fees!

- Six times point return when shopping at Rakuten Market in your birthday month!

Rakuten Card Academy

| Annual fees | Free of charge |

| Point return rate | 1.0% to 3.0% |

| International brand |  |

| E-money |  |

| Limit amount | Up to 300,000 yen |

| ETC annual fees | 550 yen (tax included) |

| Additional cards | ETC card |

| Travel insurance | Overseas travel accident insurance |

| Point name | Rakuten points |

Points to note

- Able to use “Rakuten Gakuwari” (automatically applied for students until the age of 25)

- High level of point return when used for Rakuten Books or Rakuten Travel

- Usage limit of “Up to 300,000 yen” prevents overuse

- After graduation, you automatically switch to the “Rakuten card”

- If You Wonder What Should Give a Gift, This Is the Best Choice! Cool Packaged Handkerchiefs!

- Apply on UV Cream Without Getting Your Hands Dirty! Why not Have This Handy Puff?

- So Popular Character “Chiikawa” Cheers You Up! Improve Your Arched Back!

- If You Want to Improve Your Sleep Quality, You Should Change Your Pajamas! 3 Recommended Pajamas

- Conveniently 2-Way! This Product Is Useful in Both Summer and Winter.