Income Tax Return Target, Rates, Limit, Location and Refunds

This post is also available in 日本語

You are required to pay the income tax on your income when you work in Japan. The income tax is a tax calculated based upon your income earned from January 1st to December 31st.

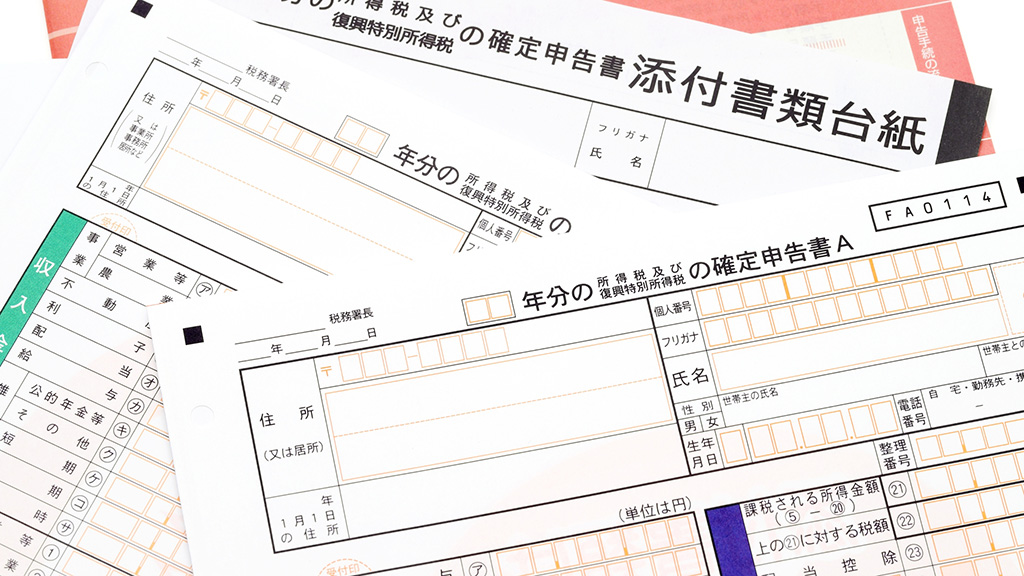

You must file an income tax return to pay income tax for yourself. You need to know the basics of the income tax system so that you don’t pay unnecessary tax and can avoid any penalty.

Contents

Who pays income tax?

Anybody with an annual income of more than \380,000 is subject to the tax. The income means the net income after subtracting expenses from the total income. For a self-employed, the amount of profit is the income. If you are paid by a company, there is the payroll deduction. The payroll deduction is a deduction in rue of expenses with a minimum amount of 650,000Yen. Therefore, when the wage income is below 1,030,000 Yen then you don’t have to pay the income tax.

Tax Rate

The income tax rate varies based upon amount of the taxable income, from the maximum of 45% and the minimum of 5%.

https://www.nta.go.jp/taxes/shiraberu/taxanswer/shotoku/2260.htm

Income Tax Calculation Formula

Total Income – Deductions and Allowances = Taxable Income

Taxable Income x Tax Rate = Income Tax

- Deductions and Allowances: Deductions for Dependents and Social Insurance Premiums and others

- Until 2037, 2.1% income tax is added as Special Income tax for Reconstruction

Refund by filing Tax Income Return

Company employees pays income tax from their monthly wages automatically. When the amount of tax you have paid is too much, you will be refunded the excess amount by filing the tax return. You can learn the amount of tax you have paid by checking the withholding income tax record issued by your company. The amount shown in the right center portion of the withholding tax record is your ‘Withholding Tax Amount’ you have paid.

https://www.nta.go.jp/taxes/tetsuzuki/shinsei/annai/hotei/pdf/h30/23100051-01.pdf

The Withholding Income Tax Record will be issued to you by January 31st of the next year. If you can’t find it, you can ask your company to reissue.

Exempt from Tax Return Filing

Everyone who has an income need to calculate the tax amount by the Tax Return. However, when your company does the year-end income tax adjustment, you need not to file the tax return. The year-end income tax adjustment is a system that your company calculate your income tax on behalf of you, based on documents you submit to them.

Please confirm with your company whether they employ this system or not. Yet, there may be a situation where you may have to file your income tax return even when your company does the year-end adjustment.

Who Needs to File the Income Tax Return?

• Has Total Income exceeding 20,000,000 Yen

• Receives employment salary from two or more companies

• Has total income outside of employment salary more than 200,000 Yen

• Is applicable of special provision of the income tax

When do you have to file the income tax return?

The filing needs to be done during 2/16 ~ 3/15 of the following year of the tax year. When the beginning date or the due date fall into a weekend or a holiday, the date will be postponed to the following Monday. The payment due date of the income tax is the same date as the dead- line for the filing. You have to be aware that when you miss the due dates of the filing and/or the tax payment, it will be subject to the penalty payment of an additional tax and a delinquent tax.

Note: For tax year 2019; the filing period 2/17 ~ 3/16/2020

the tax payment due date 3/16/2020

The return filing period for tax year 2019 will be moved forward to start on 2/17 and end on 3/16 in 2020, since 2/16 and 3/15 fall on Sundays. Therefore, the payment will be due on 3/16/2020.

Where to file your income tax return

The filing shall take place at the tax office in the area of your residence. You can find which tax office you have to file by visiting the home page of the National Tax Agency.

http://www.nta.go.jp/about/organization/index.htm

When you have any question about your tax filing, you can call and consult with the tax office. As it will be very crowded during the filing period, you want to move well in advance.

Please consult with the tax office before the filing period begins when you are uncertain of your income tax filing.

Refer to: http://www.nta.go.jp/english/index.htm

- Easily Exercise at Home! Fashionable Design Lifts You!

- Fold Up Quickly! It’s a Handy Reusable Bag When You Go Shopping!

- If You Wonder What Should Give a Gift, This Is the Best Choice! Cool Packaged Handkerchiefs!

- Apply on UV Cream Without Getting Your Hands Dirty! Why not Have This Handy Puff?

- So Popular Character “Chiikawa” Cheers You Up! Improve Your Arched Back!