Pre/postnatal pension exemptions. Criteria and how to apply

This post is also available in 日本語

A Category I Insured person who is a self-employed or a free-lance worker is now exempted from paying contribution to the national pension plan when she is bearing a child. (There has been a system in place for the Category II Insured, such as an employee of a company, to be exempted from the contribution during the maternity leave.)

However, you have to apply for the exemption! In other words, if you are not aware of the system, you will not to be exempted.

Here we show you “the Exemption System of the National Pension Plan contribution for a certain period before and after childbirth” which was enacted on April 1st, 2019.

Contents

Eligible person

- A Category I Insured under the National Pension

- A person with an expecting date later than February 1st, 2019

Who is the Category I Insured?

Every resident of Japan aged between 20 and 59 years is required to join the National Pension system. The member of the National Pension is classified into three categories: Category I insured, Category II insured and Category III insured. The easier way to define The Category I Insured is “who is not applicable to Category II and Category III Insured.”

- Category I Insured: A self-employed or a farmer and their family, and a student

- Category II Insured: Members of employees’ pension or mutual aid pension for company employees and public servants

- Category III Insured: Dependents of the Category II Insured

Guideline of childbirth

In this system, “childbirth” means that of after 85 days (4 months) of pregnancy. This includes a stillbirth, a miscarriage and a premature birth.

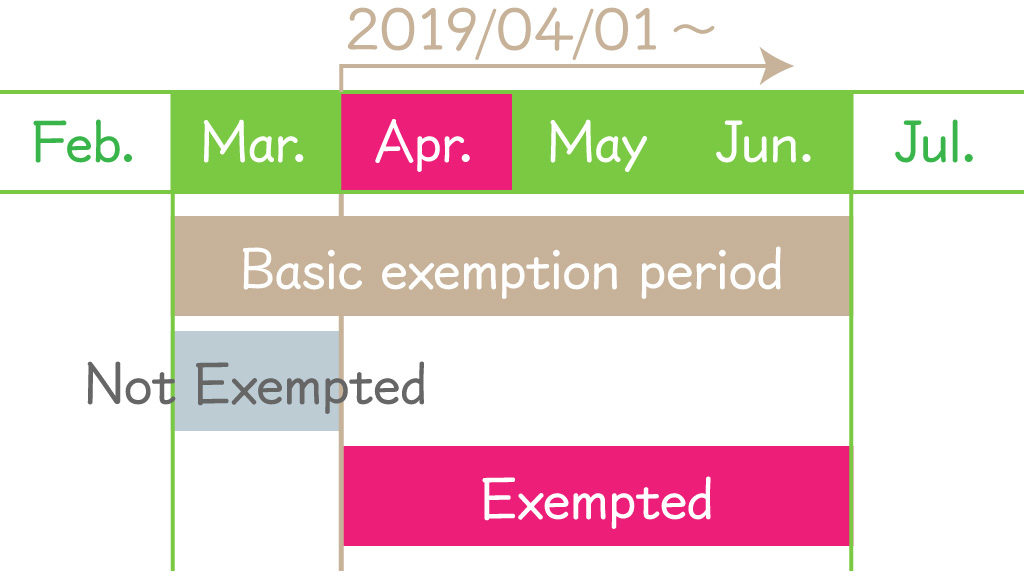

The exemption period before and after childbirth

- Four months starting from a month before the expecting date or the month of that date

(Ex. The childbirth in August: exempted for 4 months from July to October) - In case of multiple pregnancy, six months from 3 months before the expecting date or the month of the date.

(Ex. The childbirth in August: exempted for 6 months from May to October)

Attention!!

The national pension contribution you had paid during the childbirth exemption period before the enforcement of the system will not be exempted. (It would not be reimbursed.)

For an example, if the delivery date is April 2019, the exemption period is 4 months from March to June 2019. However, as the system was enacted on April 1st, the prior month, March is not covered. Therefore, you are eligible of the exemption only 3 months of April to June 2019.

How to apply?

You need to report to receive the exemption from payment of the national pension contribution.

Any applicable person shouldn’t forget to notify.

When to submit the application?

The application for the exemption may be made 6 months prior to the expected date. Also, you can apply after the delivery.

Where to notify?

You can make a report at the counter in charge of the national pension of the local municipal office where your resident registration is file.

What you need to bring with you

Reporting before delivery

- Maternity record book

- Reporting person’s identification (license, passport, etc.)

Reporting after delivery

- Reporting person’s identification (license, passport, etc.)

- When the mother and the baby don’t share the same household, a document which indicate the birth date and the parent-child relation, such as a birth certificate.

If you are not aware, you would not benefit

The before-and-after child-birth exemption period shall be counted as the period as paid. The old-age basic pension will not be reduced.

If you have pre-paid the national pension contribution covering the period of the before-and-after child-birth exemption, you will be reimbursed.

There seem to be many people who don’t know this childbirth exemption system of nation pension contribution payment since this system became effect recently. This system will not be applied if you don’t notify. If you don’t know the system, you will not benefit. Please let your family and friends who are applicable know this system.

- If You Wonder What Should Give a Gift, This Is the Best Choice! Cool Packaged Handkerchiefs!

- Apply on UV Cream Without Getting Your Hands Dirty! Why not Have This Handy Puff?

- So Popular Character “Chiikawa” Cheers You Up! Improve Your Arched Back!

- If You Want to Improve Your Sleep Quality, You Should Change Your Pajamas! 3 Recommended Pajamas

- Conveniently 2-Way! This Product Is Useful in Both Summer and Winter.